The Cost of Living: Students share experiences with inflation

In interviews and a survey issued by the Old Gold & Black, students explain how inflation has affected them and their families

The Old Gold & Black spoke to students struggling to pay for basic necessities in the wake of inflation.

October 20, 2022

Global inflation has affected all aspects of American life, including education. Over the next few weeks, the Old Gold & Black will be reporting on how inflation has affected the Wake Forest community at large. This week’s installment will focus on students and tuition/cost of living increases.

Over the past two years, the national increase in inflation has contributed to a spike in Wake Forest University’s campus costs, which some students say have led them to struggle with buying basic necessities.

Fees such as tuition, dining and housing have increased since the beginning of the COVID-19 pandemic that began in March 2020. Total student charges have risen by 7.47%, from $77,278 to $83,054.

Professor of Economics Dr. Robert Whaples explained two key reasons why inflation is on the rise.

“First, Congress spent a lot of extra money fighting the pandemic — multiple trillions of dollars — and then people started spending it, and that’s gonna push prices up. The other thing is that the Federal Reserve has been increasing the money supply. There’s a pretty classic finding in economics that when you have more money, chasing the same amount of goods, it’s going to push the prices up.”

As of August 2022, the annual inflation was 8.3%. In June, inflation was at 9.1%, the highest in 40 years. Since the pandemic, growing prices of utilities, building maintenance and dining have contributed to higher student fees.

The increase in cost of living due to inflation has affected some students’ ability to pay certain expenses. The Old Gold & Black conducted a “Cost of Living” survey to gauge how rising campus costs are affecting students. The survey did not collect an adequate number of responses, making the quantitative data unrepresentative.

Students did however share their experiences with inflation.

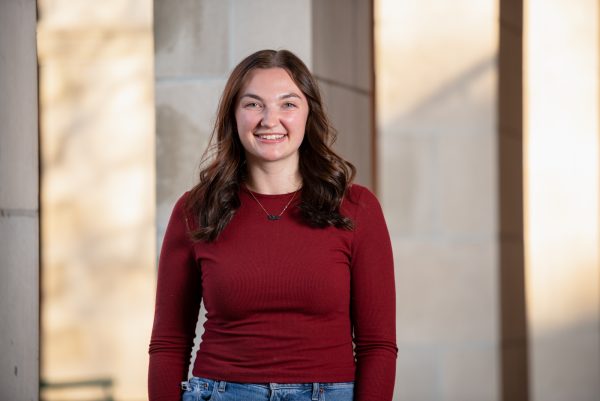

Some scholarship students, like senior Jordan Bramley, rely on a stipend to pay expenses during the school year. The increased cost of living has lessened how much students can pay for with that allocated money.

Since the COVID-19 pandemic began, Bramley has run out of stipend money by the last couple months of each semester. Before inflation was at record heights, Bramley would finish the semester with money left over, and he was buying a similar amount of groceries to what he buys now.

“I am in an apartment this year and planned on using the apartment-style meal plan,” Bramley responded on the survey. “With the cost of groceries now, the increase to my stipend was not nearly enough to offset the costs that I will incur cooking for myself. I do not know how I will eat for the entire semester.”

Bramley said that he has had to borrow money from his friends on multiple occasions and at one point in time lost upwards of 10 pounds because he had to limit his eating.

The Financial Aid office, in a statement to the Old Gold & Black, clarified their stated commitment to meeting 100% of demonstrated financial need.

“Wake Forest is among a select group of universities in the country that meets 100% of each student’s demonstrated financial need,” Tom Benza, Director of Financial Aid at Wake Forest, said. “Our financial aid budget grows each year in proportion to the cost of attendance. We have a robust analysis process with yearly updates to ensure equitable access to our need-based scholarship funds. If a student has questions about eligibility for institutional scholarships, we welcome student consultations with the financial aid office.”

Despite the assurances of the Financial Aid office, first-generation student Dianna LaTerra expressed concern regarding need-based scholarships. When asked how the Wake Forest community has been impacted by inflation and rising tuition prices, LaTerra described the challenges students can face if they are eligible for the FAFSA but do not have a high Expected Family Contribution (EFC) score — an index number that universities use to determine how much financial aid a student is eligible to receive.

“What worries me the most about tuition is the people who are financially eligible for the FAFSA but their EFC score isn’t as high,” LaTerra said. “They may have to pay more out of pocket or out of private loans than someone who can pay for [tuition] themselves. I think that those people are the most impacted by it.”

Due to the rising campus expenses, LaTerra began to budget her food dollars alongside her personal expenses. She described her experience with the cost of meals while living on campus over the summer.

“I was very mindful over the summer,” LaTerra said. “I stayed [on campus] over the summer, and I found myself being a lot more mindful of what I was purchasing to save more food dollars for the upcoming semester. I am mentally preparing myself for that.”

Several students who participated in the Cost of Living survey also noted that inflation has caused them to be more mindful of their spending.

“I have a much stricter budget now, and it’s more difficult for me to pay for things like gas when I can’t get a job during the school year,” junior Isabel Lilie responded.

Bramley shared that his scholarship stipend is supposed to help him feel “on par” with other students at Wake Forest by allowing him to afford certain expenses, however he has had to make budget cuts.

“I find myself having to make calculations between buying what I know will be good for me — things like salads, vegetables, stuff that I can cook that’s fresh, even meats and things like that — but I find myself more often than not switching to ramen,” Bramley said. “That’s a pretty standard student thing, but I don’t think that should necessarily be for a stipend that is said to help students feel at home and on par with the other students here. I don’t think that’s at all living up to it.”

He also shared how financial disparity has affected him socially.

“There are a lot of friend groups and groups of people in general that I cannot really form relationships with because their interests involve so many excess costs,” Bramley said. “I think it can be really disheartening sometimes and it has definitely made me really angry over the past few years.”

It is not just students who are feeling the pain, however. Families are also struggling to keep up with the cost of Wake Forest’s tuition. Multiple respondents indicated that they feared their families would no longer be able to retire due to the increase in attendance costs cutting into savings.

“The majority of my family’s yearly income goes into paying for my tuition,” Lilie noted in a survey response. “My parents can’t retire because they have to work to pay for me to go to school here. During COVID-19 we lost a ton of money, and Wake Forest gave us no extra aid and no help whatsoever.”

The effects of inflation on Wake Forest’s campus reflect a national trend in which universities have notably increased their fees. In the last year, the average tuition and fees at four-year private colleges like Wake Forest have risen by 2.1%.

In efforts to maintain enrollment, many universities, like Purdue University in Indiana, flattened or slightly increased tuition prices. It has been no different at Wake Forest.

“Inflation impacts higher education institutions, as it does all industries,” Shannon Badgett, Associate Vice President of Finance, Budget and Financial Planning, said. “The university’s budget is approved by the Board of Trustees each year in April. Departmental managers operate within their approved budgets and work with our procurement team to ensure competitive pricing on products and services.”

Yushuo Wang contributed to the reporting of this article.