On Monday, Feb. 5, North Carolina Attorney General Josh Stein announced that First National Bank had engaged in redlining against Black and Latino residents of Winston-Salem and Charlotte following a larger Department of Justice (DOJ) investigation and lawsuit.

The announcement was released as a settlement was reached between the U.S. government and First National, who must now pay $13.5 million back to Winston-Salem and Charlotte in the form of a subsidized loan fund.

“The funds will be used to originate loans, assist in down payment and closing costs and help pay people’s mortgage insurance premiums,” Stein’s office said in a release on Monday, Feb. 6. “The bank will also open two new branches in Charlotte and one new branch in Winston-Salem to provide financial services to residents of color.”

The remedies detailed in the settlement also stipulate that First National must spend an additional $750,000 on advertising and education in the communities of which First National had previously denied loans.

This marks the 13th lawsuit Merrick Garland’s DOJ has brought against banks for redlining practices. A similar suit from August 2022 yielded a $24 million settlement for communities in Pennsylvania, New Jersey and Delaware.

“This agreement will have a transformative impact for Black and Hispanic communities, providing them with new opportunities to become homeowners, bank in their neighborhoods and create generational wealth,” Garland said.

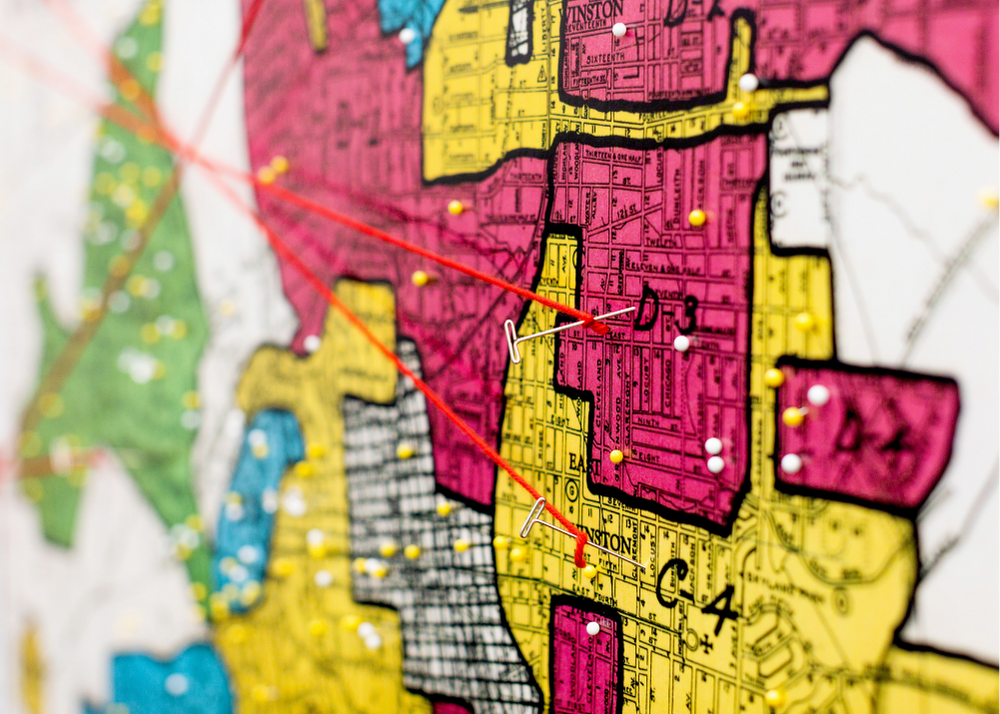

Redlining is a discriminatory practice that dates back to the time of the Jim Crow laws. — cited by experts as one of the driving sources of segregation in America. The phrase comes from housing maps that the federal government and banks consulted to determine the creditworthiness of a neighborhood. Those ranked the lowest were outlined with the color red — which were also historically Black neighborhoods. The practical effect of this created pockets of concentrated poverty among historically Black communities and spread wealth in white neighborhoods.

Although the practice dates back to the 1930s, the instances of redlining the DOJ found in their investigation are as recent as 2021. Redlining, in this case, is when banks intentionally deny or discourage loans and mortgages to minority communities to protect themselves from perceived risks. More often than not those calculations are based on racial discrimination.

The DOJ’s initial complaint alleged that First National strategically avoided majority Black and Hispanic areas by only sourcing referrals and loan applications from majority white areas. It continued to state that First National then went out of its way to maintain internal lending practices that had disproportionately low numbers of loan applications and home loans from majority Black and Hispanic neighborhoods in Winston-Salem and Charlotte.

“When banks discriminate, it means hardworking people can’t buy a house, start a business or invest in their futures,” Stein said. “I want every person who calls North Carolina home to have a fair shot, and I’m pleased that this settlement will create better borrowing opportunities for all North Carolinians.”

Winston-Salem Mayor Pro-Tempore Denise D. Adams acknowledged the success of the settlement but told the Old Gold & Black it was not enough.

“13.5 million for generations of redlining [is] a drop in the bucket, and [First National Bank has] $45 billion in assets,” Adams said. “Think about the generations that have not been able to acquire any wealth, have not been able to live a quality of life [or] provide a future for the children.”

Adams said she had lingering questions about where the number for the settlement came from. And to her knowledge, the city government was never in contact with the DOJ or AG Stein’s office.

She added that Monday’s announcement was another acknowledgment of the city’s housing crisis — she hopes this will further those conversations.

“We are in need of 16,000 units of housing — all kinds of housing. With this first step, the DOJ and Attorney Stein need to now go look at other banks […]. I think if it was me, I would go look at all [banks] to see what they’re really doing,” Adams said.

Hiram • Aug 30, 2024 at 10:33 am

So many possibilities of wealth creation and all the social goodness that it brings that was lost because of segregationist policies…