There is no good way to avoid billionaires, so we shouldn’t

Taxing the wealthy out of their billions would do more harm than good

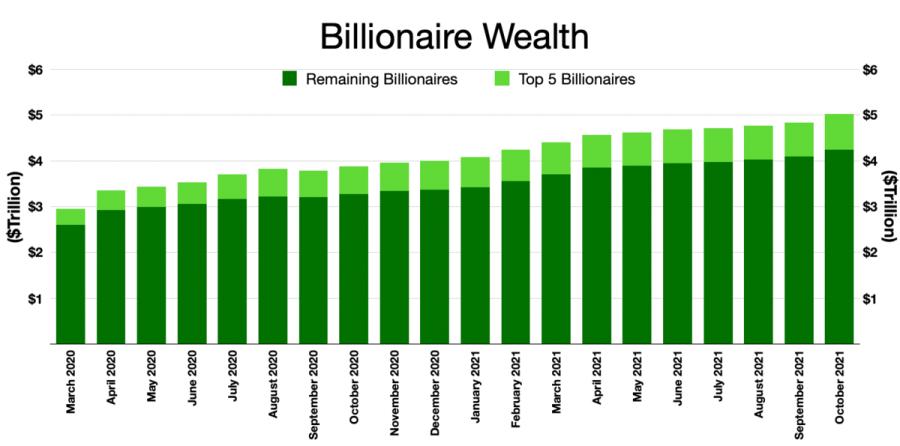

A graph shows the total wealth held by American billionaires.

January 15, 2023

Those who agree that billionaires should exist have come to this conclusion due to a shifting perception that capitalism should be unrestricted. However, modern capitalism has traveled far from its roots — mainly as a result of the deterioration of traditional values in society.

Before Adam Smith wrote “The Wealth of Nations,” he wrote another book integral to understanding the ideal way for a capitalist society to flourish. “The Theory of Moral Sentiments” outlines the idea that there is indeed room for morality in capitalism, thus it is beneficial to society.

However, the primary reason people disapprove of billionaires is that they believe billionaires lack this morality. Whether it is that they do not pay enough taxes or donate enough to charity, there is a broad perception that billionaires do not contribute their fair share to society.

As a Christian, I agree to an extent. People should donate money to the poor and help those less fortunate than themselves, and many billionaires could be doing more of this. Many of them are greedy, which is why proponents of capitalism must reemphasize the role that morality should play in capitalism through their own generosity. If society accomplished this feat, many people would likely be more accepting of capitalism as an economic system.

I wish for a society in which billionaires have less wealth, but I want this to come from a moral society that cares for others, not because the government has forced people to liquidate their assets to pay exorbitant taxes.

However, this world doesn’t exist. I hope that the world will soon achieve this desire, even if it is idealistic. Regardless of the future, there is no reason to tax billionaires into oblivion in the meantime.

Furthermore, a large percentage of the net worth of billionaires that appears on Google does not consist of liquid assets. Accordingly, any attempt to impose additional taxes, such as a wealth tax, would drastically affect the economy, as many major companies like Tesla, Amazon and Facebook would have a large number of shares dumped to pay this tax. If this were to happen, there would be a negative effect on the whole economy, harming those on the bottom of the socioeconomic ladder as well as the top.

Billionaires also serve as a model of success, incentivizing people to innovate because of the wealth they can earn by creating a new product or service. If billionaires did not exist because they were heavily taxed, people may lose motivation to develop new products and services. This also hurts society, as many products or services that could improve the quality or length of life may never come into existence.

Perhaps of foremost importance is the fact that taxation of this nature is morally wrong. Some people want to strip billionaires of their money because they believe it was acquired immorally. However, this only leads these jealous individuals toward a desire to steal themselves.

In 2021, 66% of United States billionaires were self-made, while an additional 19.3% inherited their wealth and then proceeded to increase it, according to Fox Business. Thus, only 14% of the billionaires in the U.S. inherited their wealth in its entirety. In recent decades, the percentage of self-made billionaires in the U.S. has trended upward as the financial and technology sectors boomed, highlighting the shifting dynamic of billionaires benefiting society through their own innovation and intellect. Ultimately, this wealth does not belong to U.S. citizens. In most cases, it belongs to someone who earned it through many hours of work and by taking on a great deal of risk. Therefore, nobody has the right to steal from them even if people are convinced that it is justifiable because the government will use it to help others.

Although some may perceive this claim as an argument against all taxation, a few factors differentiate this scenario from ordinary taxation. While the proper role of the government is to provide some public goods to society through taxation, targeting a specific group because of the subjective view that they are too rich is an act of theft committed out of jealousy and spite.

The assumption that excessive taxation of billionaires would help people is also questionable, as it assumes that the tax revenue acquired would directly benefit those in need. Although some of the funds may accomplish this end, there is no guarantee that the money will help others, as the government wastes a significant portion of its revenue on programs with no tangible benefit for the average American.

One recent example is an experiment through the National Institute of Health (NIH) at Georgia State University which manipulated the genes of hamsters to make them more aggressive. American taxpayers paid $1.5 million for these hamsters to fight and be scored based on their performance in a wasteful and abusive program. While this example may seem isolated, the government has a long history of funding abusive and wasteful experiments on animals, and these programs barely scratch the surface of the unnecessary programs funded with Americans’ tax dollars.

I wish for a society in which billionaires have less wealth, but I want this to come from a moral society that cares for others, not because the government has forced people to liquidate their assets to pay exorbitant taxes. A caring society is necessary because it will ultimately lead to better results for the poor, as billionaires create jobs and invent products that make people’s lives easier. Promoting generosity is superior to taxing billionaires out of existence, which is why it must be remembered that the road to hell is paved with good intentions.

I firmly believe that people who want to rid the world of billionaires are doing so from a heart that wants to help others. Unfortunately, this would not be the result, and more harm than good would ensue, hurting the American people.

Isabel • Jan 17, 2023 at 11:47 am

sources?