Much of President Donald Trump’s State of the Union address was dedicated to patting himself on the back for the “roaring” U.S. economy. It’s true that nearly 10 years into the recovery from the Great Recession, the labor market is practically at full employment, inflation is slow and steady and GDP continues to grow at a steady, moderate pace. What is not true, though, is that he deserves the credit. The economic trends and indicators that he bragged about are part of a consistent years-long pattern that barely twitched when he took office last year; Trump inherited an economy that the Federal Reserve and the Obama administration shaped and revived. However, his victory lap was particularly irksome because he failed to reappoint the person who can legitimately claim credit for the economy’s huge progress. Fewer than 24 hours after Trump’s address to Congress, Federal Reserve chair Janet Yellen presided over her last Federal Open Market Committee meeting.

The first female chair of the Fed leaves behind a near-perfect legacy at the conclusion of her four-year term. After stabilizing the economy following the Great Recession, her predecessor Ben Bernanke left her with an equally challenging task: to gently steer the stubbornly-sluggish recovery and to guide the return to pre-crisis policy. By all accounts, her performance was stellar. If we assess Yellen’s Fed by its capacity to execute the “dual mandate” set by the Congress — price stability, maximum employment — her record has been superb. The Bureau of Labor Statistics reported that the unemployment rate in Jan. 2018 remained at 4.1 percent, meaning that Yellen concluded her term at the Federal Reserve with the lowest unemployment of any chair since 1970. She oversaw a decline in the unemployment rate from 6.7 percent to 4.1 percent, the largest net improvement for any Fed chair in history. The central bank under Bernanke had dropped the short-term federal funds rate to nearly 0 percent, and in an effort to bring down long-term interest rates, had purchased nearly $3 trillion of Treasury securities in a brave and unconventional tactic known as quantitative easing. Yellen was responsible for slowly reversing this policy as the economy recovered by gradually increasing the federal funds rate in five increments to its current range of 1.25 percent to 1.5 percent and “normalizing” the central bank’s balance sheets by reducing its holdings of Treasury securities.

All of this has gone smoothly, but the fact that it would was never preordained. Increasing the federal funds rate from exceptionally low levels required new and unfamiliar procedures, and Yellen was subject to dings from the right and the left and dire predictions that things would go awry. They didn’t. By carefully watching the labor market cues and examining a wide range of data for subtle signs, Yellen was able to maintain easy-money policies long enough for the recovery to strengthen but not so long that inflation or financial speculation became a risk. Her legacy is founded on smart leadership, dignity, integrity and a rock-solid adherence to cool economic analysis of the best data available.

Yellen told the PBS NewsHour’s Judy Woodruff on Feb. 3 that she had wanted to serve an additional term at the Fed and was disappointed when Trump broke long-standing precedent and decided against re-nominating her. However, she expressed pride in her stewardship of the Fed the past four years.

“I have had the privilege and the honor of serving in very high positions in the Federal Reserve system, and in government more generally, for quite a long time, as vice chair, president of the San Francisco Fed,” Yellen said. “I have really had a seat at the table through tumultuous times, including the financial crisis and the recovery and its wake. And I’m very satisfied with the career that I have had.”

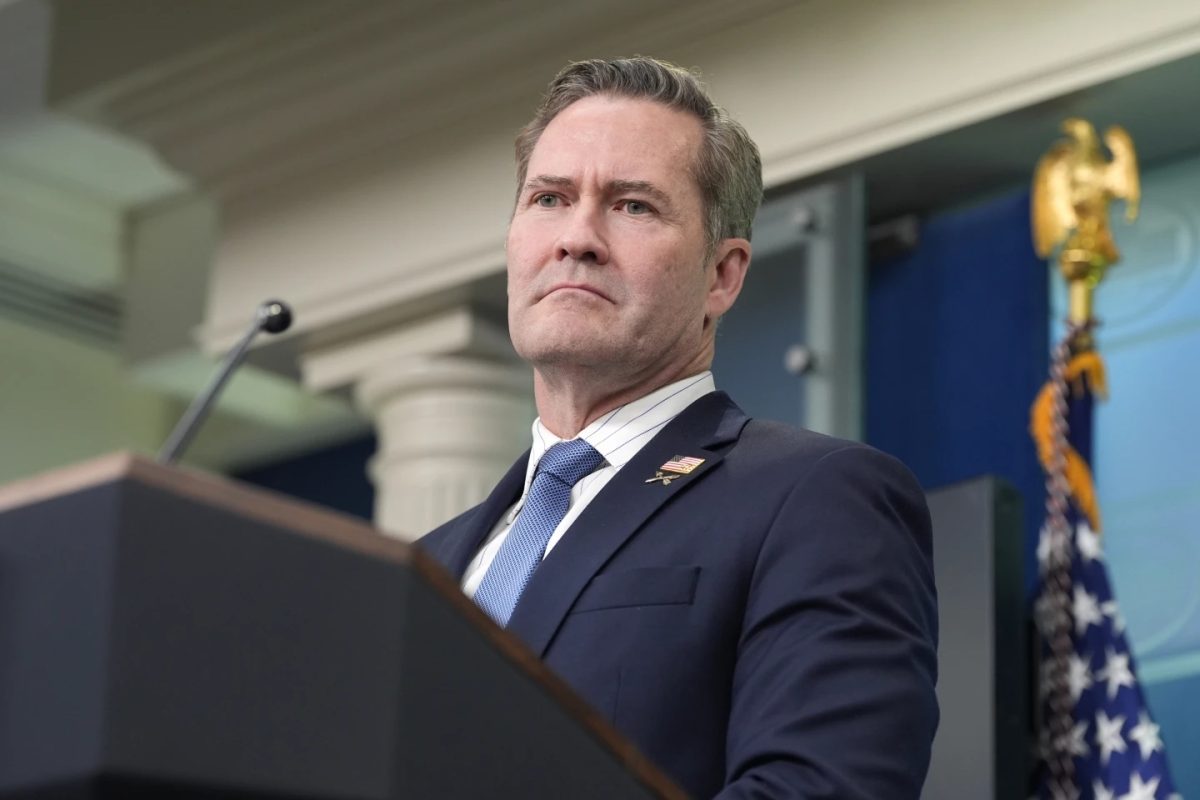

Yellen has been a great role model and inspiration to me as a student of economics; I’ll miss the woman whom I think of as the Queen of Monetary Policy. I’m also saddened and perplexed as to why Trump decided to pass Yellen over in favor of Fed governor Jerome Powell. It’s not because of monetary policy differences; there is little daylight between Yellen’s and Powell’s philosophies and both were Obama appointees. The distinction that Yellen is a Democratic woman and Powell is a Republican man is difficult to ignore. Regardless though, I look forward to seeing what is next for Yellen’s career as she joins Bernanke at the Brookings Institution. All Fed watchers can agree that Powell has very big shoes to fill.