The digital footprint that follows us off the screen (literally)

Bitcoin and other cryptocurrencies have a major environmental impact

March 28, 2023

An epoch of economic prosperity and financial freedom is imminent. Transactions worth thousands — even millions — occur in seconds, with users anonymously sending and receiving money without having to leave their living room. How? The answer lies in cryptocurrency, or “crypto.” Paperless, efficient and clutter-free, crypto has revolutionized technology and finance, but it also has extreme environmental and energy implications.

Cryptocurrency 101: A Wake Forest field trip to the crypto mines

Crypto is a form of decentralized currency that operates independently of a central authority figure, such as a bank or government institution. Without regulation, wire transfers across international borders have become simpler, as crypto acts as an anonymous system that operates without transaction fees.

Fahad Saleh, an associate professor of finance at Wake Forest University, outlines the technical mechanisms behind crypto.

“Bitcoin and other crypto operate on a blockchain,” Saleh said. “A blockchain is essentially a distributed database, a virtual chain of blocks that each contain a transaction — all chained together in a temporal order.”

He continued: “The Bitcoin blockchain operates as a payment system, where money ends up as a transaction on the blockchain. Transaction settlement is achieved when the transaction ends up stored on a block on the blockchain.”

With promises of financial freedom, decentralized currency and potential for massive returns, crypto companies Bitcoin and Ethereum are an appealing and novel form of currency. Unfortunately, as popularity rises, so do its environmental impacts.

Crypto is acquired through a “mining” process — a system of complex mathematical algorithms that verify transactions and maintain a ledger of all coins in circulation. Mining relies on a network of computers, each of which must perform significant computational work to mine new coins.

The decentralized nature of crypto means there is no entity in charge of regulating the amount of power used to run the mining network. Anyone with access to a working computer and decent internet connection can mine, offering a revolutionary and lucrative investment opportunity. However, this unchecked accessibility means that this network could become incredibly energy-intensive.

According to Raina Haque, a professor specializing in emerging technology law at the Wake Forest School of Law, the problem with mining, and Bitcoin mining in particular, is that its “security mechanism was developed to involve a very energy-expensive procedure, known as Proof-of-Work.”

Meaning, this energy-expensive security mechanism was built into the system to “disincentivize the takeover of the Bitcoin network by a malicious actor,” Haque said.

Saleh argues that Proof-of-Work has caused “Bitcoin’s levels of energy expenditure to be quite significant, leaving an equally significant environmental footprint.”

Digital Footprints that follow us off the screen

We’ve all heard of the infamous digital footprint — the permanent record of your online activity.

We’ve also all heard of the more infamous carbon footprint, which is the total amount of harmful greenhouse gas (GHG) emitted as a result of human activity. Everyday, this footprint leaves a deeper impact on Earth, increasing global temperatures while decreasing quality of life.

But the digital-carbon footprint, the terrifying love-child of both footprints, is a new force to be reckoned with.

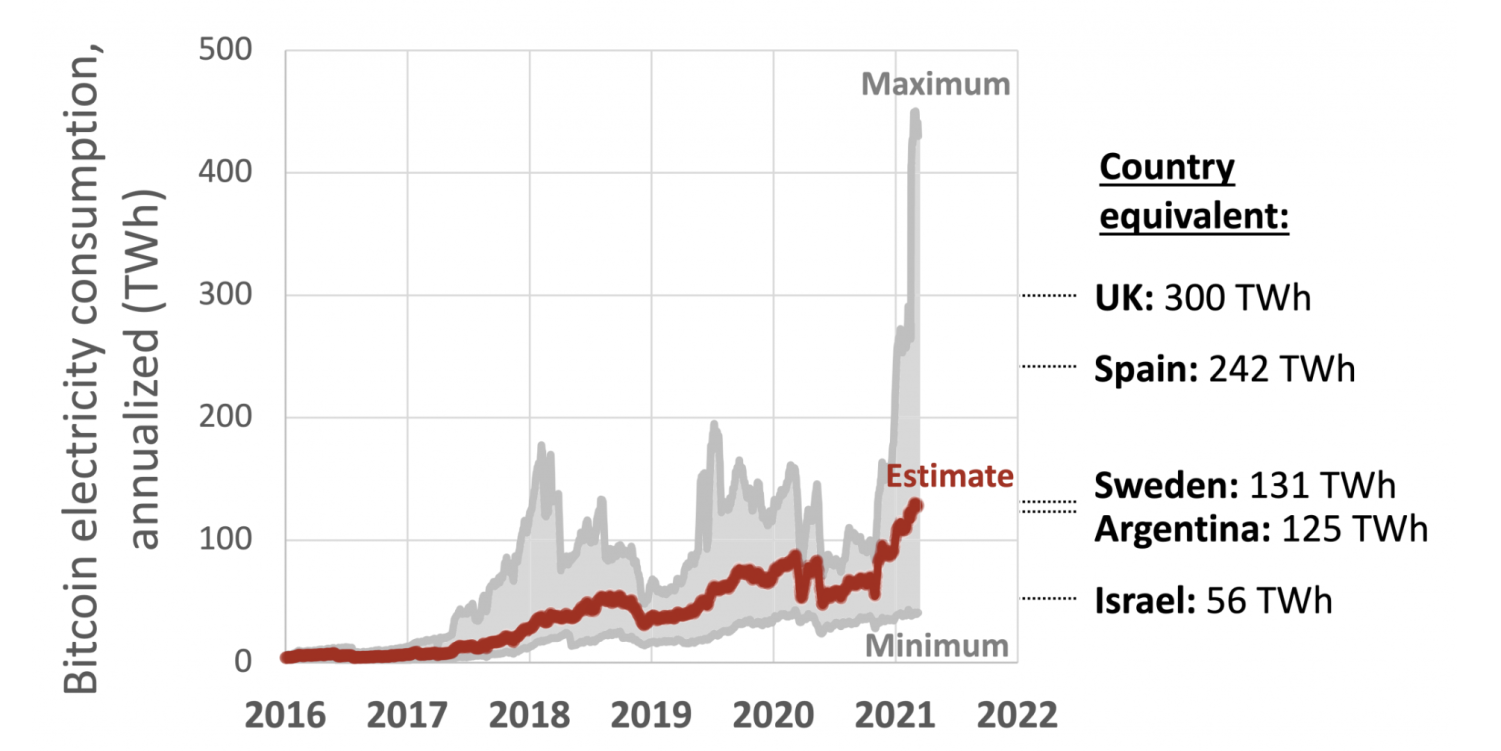

Crypto is one of the leading causes of our digital-carbon footprint. Bitcoin alone is estimated to consume around 121.36 terawatt-hours (TWh) of energy a year, according to research conducted by Cambridge University. This amount of energy a year equates to more than the energy consumption of Google, Apple, Facebook and Microsoft combined, according to Renee Cho at Columbia University.

It is estimated that crypto energy usage is responsible for the emission of about 73 million tons of carbon dioxide per year according to Digiconomist. Bitcoin is not alone — other companies like Ethereum produced an estimated 35.4 million tons of carbon dioxide in September 2022.

Additionally, as specialized hardware grows obsolete for mining purposes, miners abandon old computers to upgrade to more energy-intensive computers. Unfortunately, old Bitcoin mining hardware is unable to be reprogrammed to be reused — generating 11.5 kilotons of e-waste each year, according to Cho.

Some U.S. miners are even investing hundreds of millions of dollars to convert abandoned factories and power plants into large bitcoin mining facilities, with one notorious example being Greenidge Generation, a former coal power plant in New York that is currently one of the largest cryptocurrency mines in the country.

According to the Associated Press, generation plants in Venango County, Pa. convert coal waste into power for mining Bitcoins. In Montana, a coal-fired generating station utilizes 100% of its energy for Bitcoin mining, as well. However, it is under a power purchase agreement that offsets carbon emissions.

Despite goals established by the Paris Climate Accords in 2015 to mitigate GHG emissions and keep anthropogenic global warming within 2 degrees Celsius, researchers from the University of Hawai‘i at Mānoa argue that Bitcoin emissions alone could push global warming above 2 degrees Celsius.

Attempts to minimize the effects of crypto impress, but ultimately fall short

Several initiatives, such as the Crypto Climate Accord and the Bitcoin Mining Council, have been launched by third-party companies to reduce crypto’s digital carbon footprint. These initiatives support projects aimed toward reducing carbon emissions and push for the implementation of renewable energy methods.

One initiative, according to Haque, is known as Proof-of-Stake — an alternative security that uses almost 99% less energy than its predecessor, Proof-of-Work.

The key takeaway is that a network of energy-intensive mining devices no longer need to compete with each other to create the next block for the underlying blockchain anymore. Thus, energy emissions have an opportunity to be reduced. One successful example is Ethereum, which was able to drop its emissions by 99.95% following its transition to the new Proof-of-Stake algorithm.

However, Haque noted, “People do criticize Proof-of-Stake for being less secure, as one of the key security features of Proof-of-Work is that its costly system disincentivizes bad actors from taking over. Proof-of-Stake critically lacks that same disincentive.”

Crypto, however, remains an unregulated venture in which people and governments have invested millions of dollars. Transitioning to a more energy-efficient system, although theoretically possible, would be difficult and idealistic, according to a Columbia Business School professor in an interview with Cho.

The key to overcoming the Bitcoin bandwagon, according to Saleh, lies in the government. Saleh says that the governmental focus should emphasize policies that are more supportive of other crypto platforms to undermine Bitcoin’s relevance.

Haque echoes this notion: “ Incentives, like tax deductions or credit for joining specific networks should be offered to incentivize people on to the government’s preferred networks … Ultimately, the goal should not be to shut down Bitcoin, but it should be to draw people away from the overall network.”

To maintain popular relevance, cryptocurrencies will no longer be able to ignore environmental considerations. Bitcoin specifically is neither reliable nor sustainable in today’s culture. In the words of Saleh, “Bitcoin is a falling star, not a rising consideration.”

It’s up to the next generation

Cryptocurrency itself may be digital, but its impacts can lead to real-world consequences. While digital currency has the potential to be the lucrative future of money and the global economy, it also has the propensity to harm the environment.

These questions have remained a hot topic at Wake Forest since 2020. During the pandemic, Haque remembers the Hackathon, a Wake Forest event held that dealt with topics regarding a more equitable and efficient use of blockchains.

Saleh teaches a class at Wake Forest where students can design their own crypto using the Proof-of-Stake algorithm in its blockchain to minimize its respective carbon footprint.

According to Saleh and Haque, Wake Forest is doing more than other universities to educate its students about blockchain and engage them in this emerging sphere of technology through classes, interactive seminars and campus events.

Haque sums up the situation from a broader scope.

“We went from a society of hunter-gatherers, then discovered trading in commodities,” Haque said. “We slowly began recognizing other instruments for trades, like notes and debts, to currencies. And now, we are here, transitioning from the American dollar to the digital era of crypto.”

He continued: “Crypto is a first-time use of this type of technology. This is just the first bubble that has to pop before things stabilize and we move into an era of digital currency and digital assets.”

According to Haque, the world is in a hiccup space right now, but things will eventually settle down. The fate of crypto is dependent on us — the upcoming generation of leaders, entrepreneurs and conservationists. There is hope yet that the grass is greener on the other side of the crypto venture.

Update March 29, 2023: This article’s subhead has been updated.