Do you like your iPhone? Your sushi? Your Starbucks? These essentials of the American lifestyle are what economists might call benefits of economic growth, and may be at risk because of our $20,000,000,000,000 ($20 trillion) of national debt.

Should we be afraid? Pedestrians near the U.S. National Debt Clock in NYC, which has been flashing this ever-increasing number in bright LED lights since 1989, seem to be.

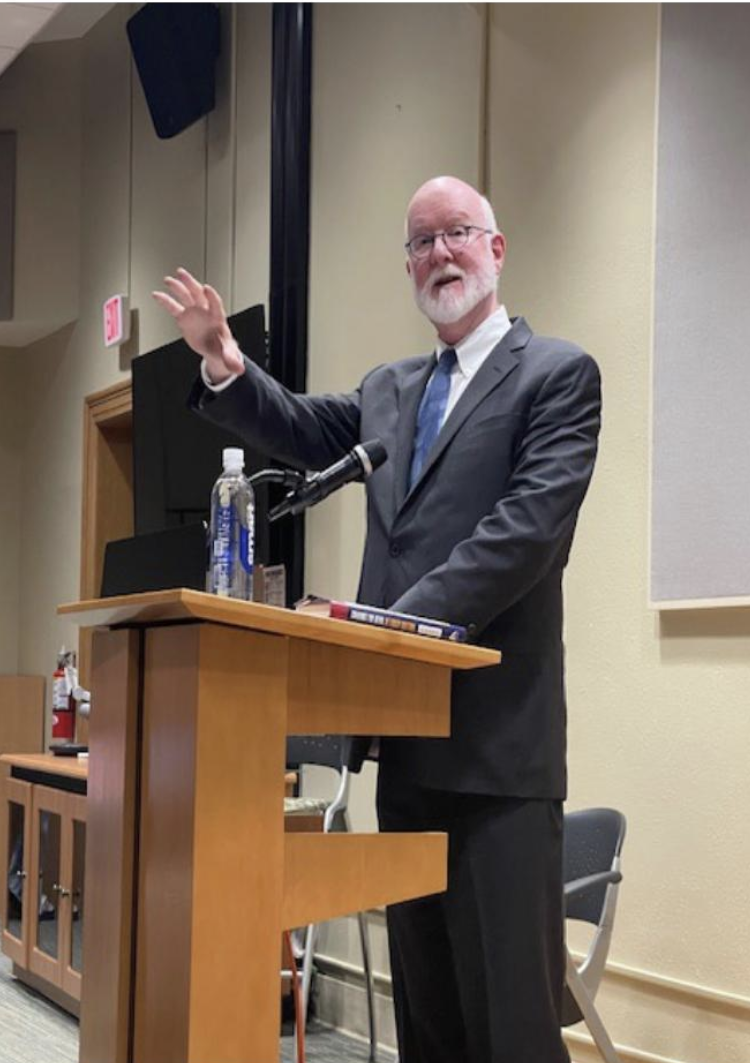

Investment in physical capital (such as tools and machinery) and human capital (such as education and skills) foster our economy’s expansion. As a student that will soon enter the workforce I am worried about what this means. However, this past Monday I went to a talk by Professor Richard Salsman, a political economics professor at Duke, and am reassured that our economy will not collapse, though our ever-rising standard of living may come to a halt.

Professor Salsman began by reiterating common knowledge: most perceptions of public debt are pessimistic. Public debt cannot possibly be a good thing for our economy, right? Well, not exactly. Salsman intimated that there are some hidden benefits to public debt; specifically, more public debt equates to lower taxation today, meaning we have more discretionary funds available to buy the essentials of a 21st century American lifestyle (like Starbucks). The question then becomes: do the benefits of public debt outweigh the consequences? Before we delve into the nitty gritty of the U.S. debt, we need to understand two important terms: Gross Domestic Product (GDP) and public leverage. GDP refers to the market value of all final goods and services produced within a country during a given time period — typically a year — and public leverage is the debt of the government, which represents the public, divided by GDP; in other words, this is the U.S.’s borrowing relative to its asset base. This means that our GDP, which represents the collective assets of American citizens, is our collateral on defaulting (not paying back) the money lent to us.

How does our government borrowing money impact your ability to buy Nike shoes or other items you want? A possible answer can be found by comparing our own public leverage with Japan’s. Currently, the U.S.’s public leverage is approximately 105 percent, (calculated by dividing our $20 trillion debt by our $19 trillion GDP), meaning we are borrowing more money than we generate. In contrast, Japan’s public leverage is over 250 percent. Why is this important? Because, having been in our position, Japan may act as an indicator about the long-term consequences of excessive borrowing.

A growing economy equates to a higher standard of living, but there may be a point where governments borrow too much money. Harvard economist Kenneth Rogoff with his colleague Carmen Reinhart suggest that the point of no return may be 90 percent public leverage (debt-GDP ratio). The Japanese economy, which has more-or-less stagnated since surpassing this ratio about twenty years ago, supports this theory.

I mentioned earlier that the U.S.’s public leverage was about 105 percent, yet we are still in a period of economic growth. Why? Well, for one thing, the U.S. government prints its own money, which is an effective way of helping the government finance various programs that help increase our standard of living. If, as Salsman mentioned towards the end of his presentation, Japan can be considered a leading indicator of our economy’s fate, then until the point that no one trusts our currency, there should be no limit on our public leverage.

Keep in mind that Japan’s public leverage is about 2.5 times what ours is today, and their economy has seen low investment returns and stunted growth — to which many investors attribute associated subpar investment returns which correlate with a slower-rising standard of living. To the extent that Japan’s economy acts as an indicator, the long-term consequence of our government borrowing money may be lower investment returns and a stalled economy that may result in a lower standard of living — until, as Salsman qualifies, someone stands up and campaigns for less government involvement and more free-market operations. So, for now I guess, we can rest easy knowing that the Starbucks on the corner and the Chipotle down the street will be open for the foreseeable future.