In 1932, during the deepest abyss of the Great Depression, President Franklin Delano Roosevelt called for “bold, persistent experimentation” and said, “It is common sense to take a method and try it; if it fails, admit it frankly and try another. But above all, try something.”

Senate Republicans, however, who squeaked a trillion-dollar tax overhaul bill through the Senate, are taking a different approach: try a method and when it fails, deny its failure and try it again. And again. And again.

The main elements of their bill are, at heart, yet another reprise of the same supply-side economic principles that Republicans have praised for decades, but which have never worked out.

Because the Republican leadership hastily forced their bill through the committee and frantically rewrote it as it careened toward the floor for a vote sans hearings, specifics are fuzzy.

It must also still be reconciled with the version the House of Representatives passed.

One thing is clear, though: the bill would be a windfall for the wealthy and one way or another, it would eventually hurt most Americans.

Middle-class taxpayers would be thrown a few breadcrumbs in the form of modest tax cuts, but those would sunset after 2025 while massive corporate tax cuts would remain.

Ultimately almost two-thirds of middle-class families would see substantial tax increases by 2027, concludes the Tax Policy Center.

By that time, the plan would be, in short, a tax increase on the middle class used to pay for tax cuts that primarily benefit the extremely wealthy.

Although the old conservative adage is that the concentration of even more wealth in the hands of the richest Americans leads to economic growth benefitting the rest of us, supply-side economics just doesn’t work.

We can look to the instructive arc of history for examples. For instance, many experts agree that massive tax cuts to the wealthy under President Calvin Coolidge during the 1920s substantially contributed to economic collapse in 1929, and a modest increase in the top marginal tax rate under President Bill Clinton led to a period of great economic prosperity and the budget surpluses at the end of the 1990s.

You don’t need a Ph.D in economics to know that something is amiss with the logic of supply-side economics.

If it was a reality, inequality would be self-limiting: as the rich got richer, wealth would cascade down to the lower classes.

However, the gap between the richest Americans and the working poor continues to grow.

Even after taxes and transfer payments have supposedly done their leveling work, the U.S. currently has one of the highest Gini coefficients (a metric used to measure income inequality) in the developed world.

Increasing the tax burden on middle-class families while giving the top one percent a windfall would only worsen this problem; claims that wealth will “trickle down” are naive at best and a bold-faced lie to the wanna-believe American electorate at worst.

It’s time to stop running the old playbooks that don’t work and to try something new.

If Republicans sincerely want to achieve economic growth and development, there’s a laundry list of policies to consider.

A good start would be to ensure that all Americans have fair and equal access to health care; naturally, a sick workforce isn’t maximally productive.

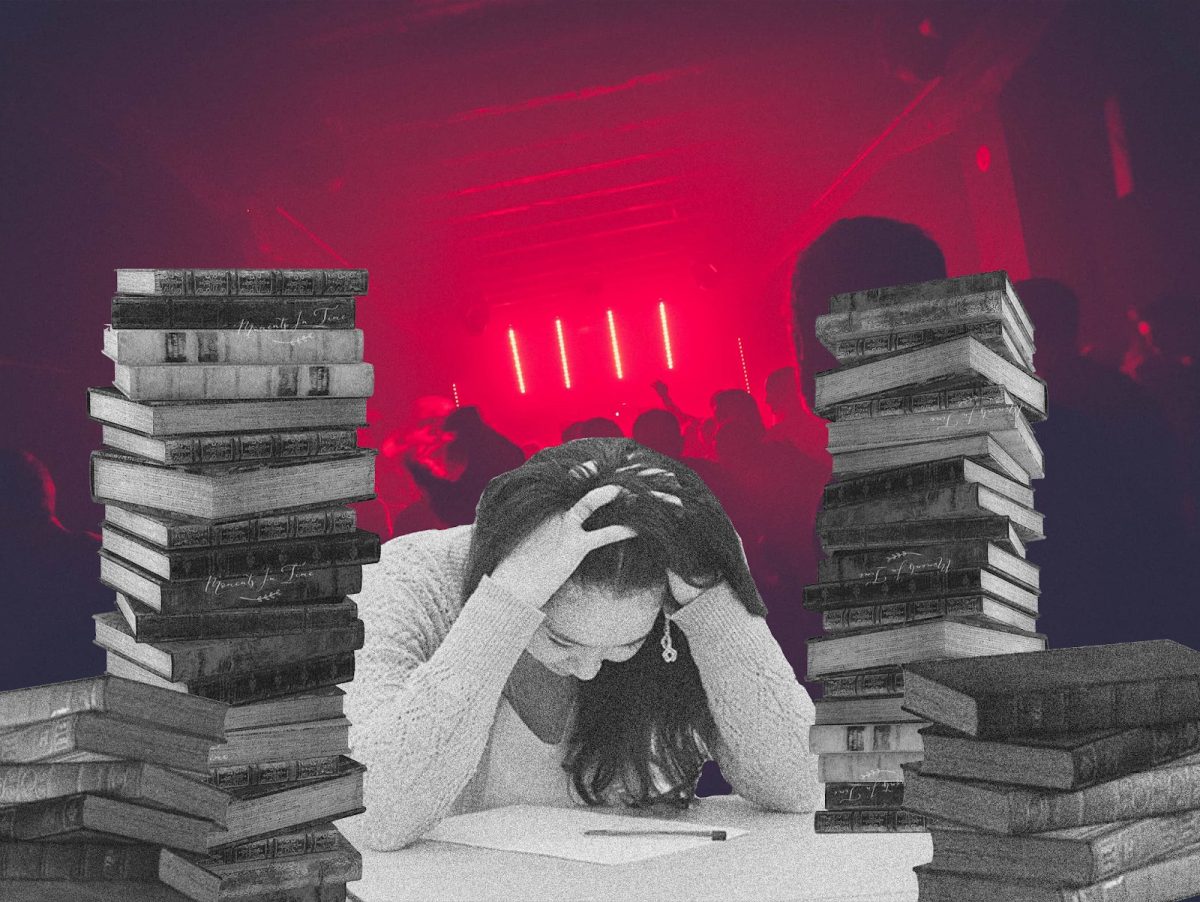

But a provision rolled into the current bill seeks to repeal the individual mandate, which would destabilize the Obamacare marketplace. Another good step would be to help students pursue higher education to grow the workforce’s intellectual capital.

But the bill scraps deductions for college students with loans and forces graduate students with tuition waivers to count that money as income for tax purposes.

Additionally, keeping the national debt in check could constrain the crowding out effect on investment. According to the Joint Committee on Taxation, though, this bill risks adding a minimum of $1 trillion more to the existing $20 trillion national debt. Unfortunately, partisanship is a hell of a drug, and even the most self-avowed fiscal conservatives in the Senate have been magically cured of their aversions to deficit spending.

Only Republican Sen. Bob Corker of Tennessee has had the intellectual integrity not to give in — at least not yet.

I’d like to see Democrats do a little more than shake their fists à la Sens. Elizabeth Warren and Bernie Sanders in response to a bill that has been empirically proven to be damaging to the U.S. economy.

Although their bill stalled, the cooperation between Sens. Patty Murray (a Democrat) and Lamar Alexander (a Republican) on health care reform was an encouraging demonstration of bipartisanship.

If a caucus of established and well-respected Democratic senators, such as Sens. Mark Warner, Claire McCaskill, Dick Durbin and Ed Markey, to name a handful of possibilities, followed suit and teamed up with Sen. Corker, perhaps they could strike a workable deal.

Real opposition to the Trump agenda is going to take more than tweets of outrage or even the most hardy filibusters.

Democrats and Trump’s Republican opponents must find a way to offer disaffected Americans material progress; nay, they need to make the case that their policies are the way to a better future.

Championing real tax reform with a goal of developing the economy for all Americans — not lining the pockets of corporate donors — would be a good start.

Tom Daly • Feb 17, 2018 at 8:07 pm

The Republicans are Bankrupting the country.

You’ve heard the scary statistics about government spending. You have heard it from the Congressional Budget office or Congressional Research Service or you’ve heard it from House Speaker Paul Ryan or Office of Management and Budget Director Mick Mulvaney.

There are no shortage of professionals sounding the alarm, including the conservative Heritage Foundation. The Republican Congress and Trump are bankrupting the country and robbing future generations of Americans. It’s dangerous. A debt crisis, and all the terrible economic effect sof that, are looming.

How did this happen? It follows a familiar script.

Republican Reagan gave us the largest tax cuts in history (by % GDP), and tripled the US debt.

Republicans George W Bush inherited a balanced budget from Democrat Clinton and decided to cut taxes and fight two wars on the US credit card. He handed Obama a trillion dollar deficit and the great recession.

Trump follows the script and has more tax cuts – guaranteeing never before seen deficits and thus increasing the debt “bigly”.

Who has this helped? Since Reagan in 1981 the income of the top 1%

and 10% has exploded while the median family income in the US has hardly kept up with inflation. Meanwhile the wealth of the Forbes 400 has almost tripled in inflation adjusted dollars. The profits and capitalization of the

Fortune 500 have never been so high. The economy has finally fully recovered from the Bush/Cheney great recession, and unemployment at the end of the Obama administration was 4.7%. Why tax cuts now, and stimulate the economy? What conservative economic philosophy is this? Not Freedman, not Hayek, not Smith. It is not even Keynes.

The US military already outspends Russia and China combine more than 2 times over, with the next ten countries allies of the US. Unlike the other

departments of government, the Pentagon has not been able to conduct an audit of its spending for two decades. The Pentagon cannot say where they are spending hundreds of billions of dollars. Recently the Pentagon has buried an internal study that exposed $125 billion in administrative

waste. Pentagon leaders had requested the study to help make their enormous back-office bureaucracy more efficient and reinvest any savings in combat power. But after the project documented far more wasteful spending than expected, senior defense officials moved swiftly to kill it by discrediting and suppressing the results

What is the goal of the Republican congress? Will the Ryan and the

Republicans now demand cuts to Social Security, Medicare and Medicaid and

others to “balance” the budget” they threw even more out of balance? In what world is this rational? At what point will American capitalism and democracy collapse? I feel sorry for anyone now in school.

The Republicans would not support a stimulus in 2008-10 when the economy was in the Bush-Cheney great recession and unemployment was near 10%. Now with unemployment below 5% the Republicans have passed two bills that stimulate the economy, a tax bill with will a built in deficit of well over a trillion dollars and a budget that will drive the debit up another trillion plus dollars. It would be interesting if the Business faculty would comment on this from their perspective.

Farmer Don • Jan 4, 2018 at 6:54 am

What in your definition constitutes “the rich”? When I see that term and “fair share” my eyes glaze over. I know I am about to get a redistributionist proposal. If someone makes money, a little or a lot, they will spend it or invest it or give it away, all of which helps the economy. The more the merrier. The only fair tax is a consumption tax. Everyone should contribute to the cost of defense, public services, roads, schools etc. Don’t worry, your “rich” will pay more because they spend more. Everyone will benefit from the transparency of the tax, thus creating a broad interest in controlling government spending. Give everyone an annual rebate that in effect makes the cost of basic food and clothing tax free. No means test. Do you know what percentage now pay no tax and thus are willing to vote for demagogue class warriors? The typical small business owner or farmer understands economics better than most professors.

Farmer Don • Jan 3, 2018 at 9:35 pm

Inaccurate liberal cant, class warfare and shallow analysis. Hopefully you will learn to reason with more depth, find the facts and not parrot your obviously limited sources. Which professor are you trying to impress?